The criminal network defrauded Dutch tax authorities of an estimated €9 million

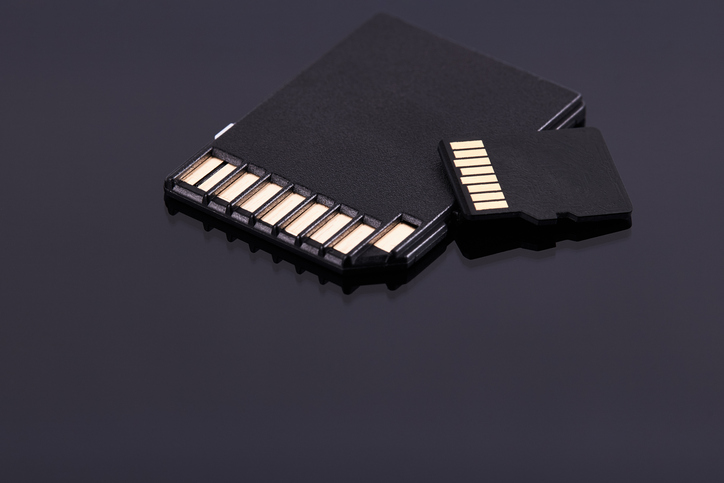

On 10 February 2021, the investigation service of the Dutch tax authorities -FIOD (Fiscale Inlichtingen en OpsporingsDienst) busted a criminal network involved in international VAT fraud with electronic devices traded via an online company. Fraudsters established a complex trading scheme with Secure Digital (SD) memory cards for electronic devices, which is believed to have defrauded the Dutch treasury of an estimated €9 million between 2017 and 2019. The international sting involved the collaboration of judicial and law enforcement authorities in Croatia, Czech Republic, Hungary, and Poland with the support of Europol and Eurojust. During the action day, investigators carried out thirteen house searches and seized communications equipment and documents.

A complex missing trader intra-community fraud (MTIC)

The illegal VAT scheme consisted in the suspicion of a fake trading circuit of memory cards involving a string of companies in the EU. The criminal gang purchased SD cards with VAT from Dutch companies identified as missing traders. The goods were then sold to companies in Croatia, and the Czech Republic and exempted of VAT according to intra-EU tax rules. To evade tax payment, the scheme finally used conduit companies based in Croatia and Poland to sell back the VAT-exempt goods to the missing traders in the Netherlands.

The organised crime group also used “buffers” to conceal the illicit transaction chain. These companies purchased the SD cards from the missing traders and only paid VAT on a small margin made from the transactions. As a common practice in MTIC fraud the payment for the transactions was made in advance. It is believed that over the past three years, at least eight missing traders in the Netherlands were involved in this fraud. The criminal gang integrated this so-called ‘VAT carousel fraud’ into the regular commercial activity of an online company selling electronic devices in order to avoid paying VAT.

Europol Support

Europol actively supported the operation by providing analytical support and operational coordination for an effective cross-border cooperation. Moreover, Europol deployed a mobile office in the field to support the Dutch authorities in real-time.

Europol’s European Financial and Economic Crime Centre (EFECC) helps with identifying and dismantling organised criminal networks involved in cross-border VAT fraudand the tracing and confiscating of the proceeds of MTIC fraud. MTIC is committed through a chain of linked companies when the fraudsters sell goods or services from one EU country to another, taking advantage of the fact that it is legitimate not to charge VAT on such cross-border transactions. MTIC scammers obtain €60 billion in criminal profits every year in the EU by avoiding the payment of VAT or by corruptly claiming repayments of VAT from national authorities.